Jim Simons' Education

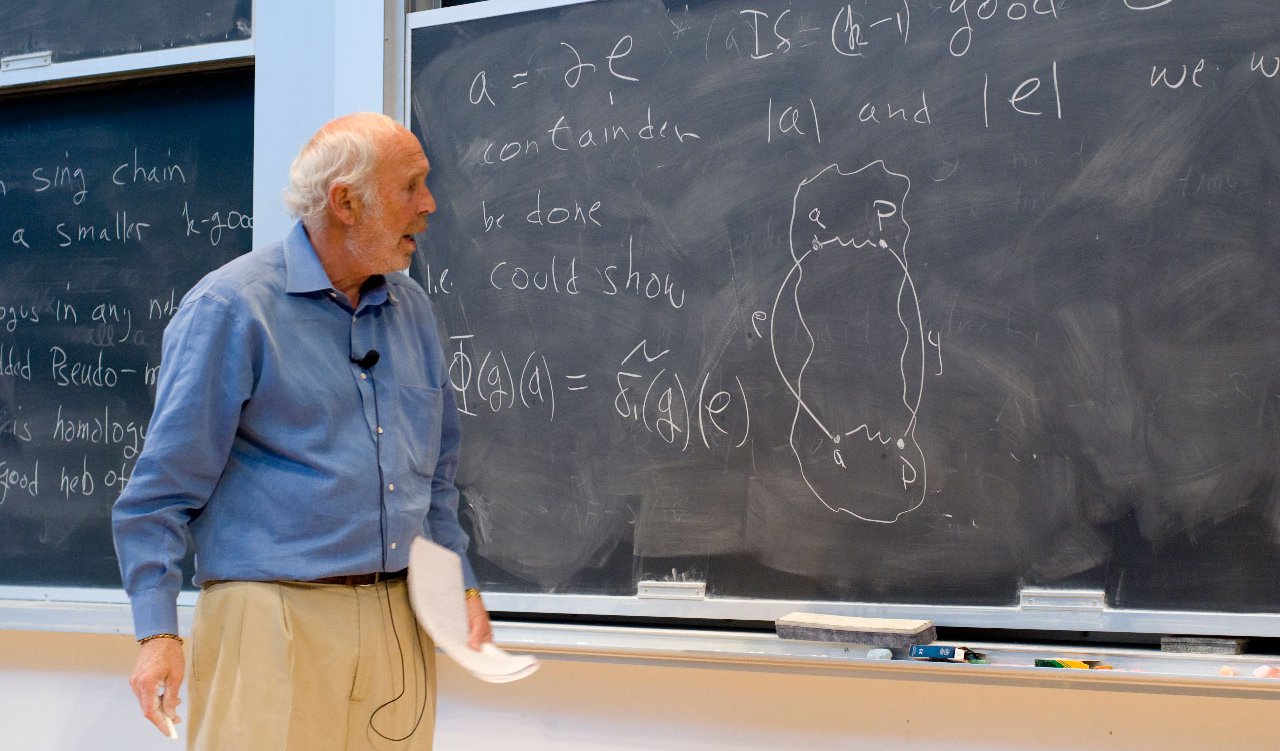

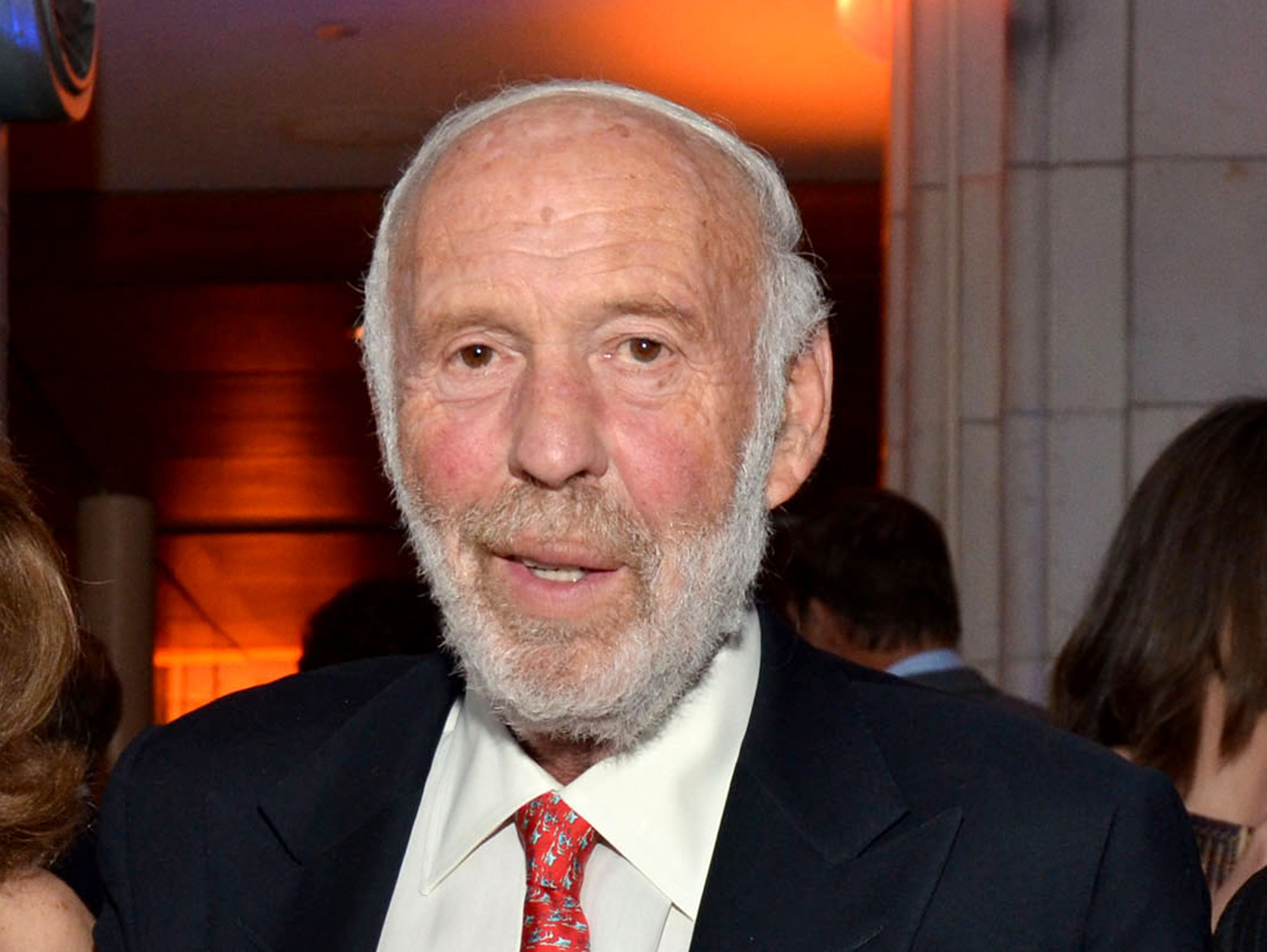

Jim Simons is an American mathematician, hedge fund manager, and philanthropist. He is the founder and former CEO of Renaissance Technologies, a hedge fund known for its quantitative trading strategies. Simons has a PhD in mathematics from the University of California, Berkeley, and an MBA from the Massachusetts Institute of Technology.

Simons' education has been instrumental in his success as a hedge fund manager. His PhD in mathematics gave him the quantitative skills necessary to develop and implement trading models. His MBA from MIT gave him the business knowledge necessary to manage a hedge fund.

Simons' education is a testament to the importance of education in the field of finance. A strong foundation in mathematics and business is essential for success in the hedge fund industry.

Jim Simons' Education

Jim Simons' education has been instrumental in his success as a hedge fund manager. A strong foundation in mathematics and business is essential for success in the hedge fund industry.

- PhD in Mathematics from the University of California, Berkeley

- MBA from the Massachusetts Institute of Technology

- Quantitative trading strategies

- Hedge fund management

- Renaissance Technologies

- Billionaire

- Philanthropist

- Mathematical modeling

- Computer science

- Data analysis

Simons' PhD in mathematics gave him the quantitative skills necessary to develop and implement trading models. His MBA from MIT gave him the business knowledge necessary to manage a hedge fund. Simons' education is a testament to the importance of education in the field of finance.

Simons is a self-made billionaire who has donated millions of dollars toand educational institutions. He is also a strong advocate for quantitative trading and data analysis.

PhD in Mathematics from the University of California, Berkeley

Jim Simons' PhD in Mathematics from the University of California, Berkeley is a key component of his education and has been instrumental in his success as a hedge fund manager.

- Quantitative Skills: A PhD in Mathematics provides students with a strong foundation in quantitative skills, which are essential for developing and implementing trading models. Simons' PhD in mathematics gave him the skills necessary to develop the complex trading models that have made Renaissance Technologies so successful.

- Problem-Solving Skills: A PhD in Mathematics also develops problem-solving skills, which are essential for success in any field. Simons' problem-solving skills have helped him to overcome the many challenges that he has faced in his career.

- Critical Thinking Skills: A PhD in Mathematics also develops critical thinking skills, which are essential for making sound investment decisions. Simons' critical thinking skills have helped him to identify undervalued assets and to make profitable trades.

- Communication Skills: A PhD in Mathematics also develops communication skills, which are essential for managing a hedge fund. Simons' communication skills have helped him to build a strong team of investment professionals and to communicate his investment strategies to investors.

Overall, Jim Simons' PhD in Mathematics from the University of California, Berkeley has been a key factor in his success as a hedge fund manager. His education has given him the skills and knowledge necessary to develop and implement successful trading strategies.

MBA from the Massachusetts Institute of Technology

Jim Simons' MBA from the Massachusetts Institute of Technology (MIT) is another key component of his education and has been instrumental in his success as a hedge fund manager.

An MBA from MIT provides students with a strong foundation in business and management principles, which are essential for managing a hedge fund. Simons' MBA from MIT gave him the skills necessary to manage the day-to-day operations of Renaissance Technologies and to make sound investment decisions.

In addition to the business and management skills that he learned at MIT, Simons also developed a network of valuable contacts that have helped him to succeed in the hedge fund industry.

Overall, Jim Simons' MBA from MIT has been a key factor in his success as a hedge fund manager. His education has given him the skills and knowledge necessary to manage a successful hedge fund.

Quantitative trading strategies

Quantitative trading strategies are a key component of Jim Simons' success as a hedge fund manager. Simons has a PhD in mathematics from the University of California, Berkeley, and an MBA from the Massachusetts Institute of Technology. His education gave him the skills necessary to develop and implement the quantitative trading strategies that have made Renaissance Technologies so successful.

- Mathematical modeling: Quantitative trading strategies use mathematical models to identify undervalued assets and to make profitable trades. Simons' PhD in mathematics gave him the skills necessary to develop these models.

- Computer science: Quantitative trading strategies also use computer science to process large amounts of data and to execute trades quickly. Simons' MBA from MIT gave him the skills necessary to manage the technology infrastructure necessary for quantitative trading.

- Data analysis: Quantitative trading strategies also use data analysis to identify trends and to make predictions about future market movements. Simons' PhD in mathematics and his MBA from MIT gave him the skills necessary to analyze data and to make sound investment decisions.

- Risk management: Quantitative trading strategies also use risk management techniques to protect against losses. Simons' PhD in mathematics and his MBA from MIT gave him the skills necessary to develop and implement risk management strategies.

Overall, Jim Simons' education has been instrumental in his success as a hedge fund manager. His education gave him the skills necessary to develop and implement the quantitative trading strategies that have made Renaissance Technologies so successful.

Hedge fund management

Hedge fund management is a complex and challenging field that requires a deep understanding of financial markets, investment strategies, and risk management. Jim Simons' education has given him the skills and knowledge necessary to be a successful hedge fund manager.

- Quantitative trading strategies: Hedge funds often use quantitative trading strategies to identify undervalued assets and to make profitable trades. Simons' PhD in mathematics and his MBA from MIT gave him the skills necessary to develop and implement these strategies.

- Risk management: Hedge funds also need to manage risk carefully in order to protect their investors' capital. Simons' PhD in mathematics and his MBA from MIT gave him the skills necessary to develop and implement risk management strategies.

- Business management: Hedge funds are businesses, and they need to be managed effectively in order to be successful. Simons' MBA from MIT gave him the skills necessary to manage the day-to-day operations of a hedge fund.

- Leadership: Hedge fund managers need to be able to lead and motivate their teams. Simons has a strong track record of leadership, and he has been able to attract and retain top talent at Renaissance Technologies.

Overall, Jim Simons' education has been instrumental in his success as a hedge fund manager. His education gave him the skills and knowledge necessary to develop and implement successful trading strategies, manage risk, and lead a successful business.

Renaissance Technologies

Renaissance Technologies is a hedge fund founded by Jim Simons in 1982. The firm is known for its quantitative trading strategies, which have generated impressive returns for investors over the long term.

Simons' education has been instrumental in the success of Renaissance Technologies. Simons has a PhD in mathematics from the University of California, Berkeley, and an MBA from the Massachusetts Institute of Technology. His education gave him the skills necessary to develop and implement the quantitative trading strategies that have made Renaissance Technologies so successful.

Renaissance Technologies is a major employer of mathematicians, physicists, and computer scientists. The firm's research team is constantly developing new trading strategies and improving existing ones. Renaissance Technologies also has a strong track record of innovation, having developed some of the most advanced trading technologies in the world.

The success of Renaissance Technologies is a testament to the importance of education in the field of finance. A strong foundation in mathematics, computer science, and business is essential for success in the hedge fund industry.

Billionaire

Jim Simons is a billionaire hedge fund manager and philanthropist. His net worth is estimated to be $25 billion. Simons' education has been a key factor in his success. He has a PhD in mathematics from the University of California, Berkeley, and an MBA from the Massachusetts Institute of Technology.

Simons' education gave him the skills and knowledge necessary to develop and implement the quantitative trading strategies that have made him a billionaire. His PhD in mathematics gave him the mathematical skills necessary to develop these strategies. His MBA from MIT gave him the business skills necessary to manage a hedge fund.

Simons is a self-made billionaire. He started Renaissance Technologies with just $600,000 in 1982. The firm now manages over $100 billion in assets. Simons' success is a testament to the importance of education in the field of finance. A strong foundation in mathematics and business is essential for success in the hedge fund industry.

Philanthropist

Jim Simons is a philanthropist who has donated millions of dollars to educational institutions and other charitable causes. His philanthropy is motivated by his belief that education is the key to success and that everyone deserves a chance to reach their full potential.

- Support for Education

Simons has donated millions of dollars to universities and other educational institutions, including the Simons Foundation, which he founded in 1994. The Simons Foundation supports a wide range of educational initiatives, including scholarships, research grants, and programs to improve science and mathematics education.

- Support for Science and Research

Simons has also donated millions of dollars to scientific research, including the Simons Foundation Autism Research Initiative, which he founded in 2003. The Simons Foundation Autism Research Initiative supports research into the causes and treatments for autism.

- Support for the Arts

Simons has also donated millions of dollars to the arts, including the Simons Foundation for the Arts, which he founded in 2009. The Simons Foundation for the Arts supports a wide range of artistic endeavors, including music, dance, and theater.

- Support for Social Justice

Simons has also donated millions of dollars to social justice causes, including the Simons Foundation for Social Justice, which he founded in 2016. The Simons Foundation for Social Justice supports a wide range of social justice initiatives, including criminal justice reform, voting rights, and immigration reform.

Simons' philanthropy is a reflection of his belief that everyone deserves a chance to reach their full potential. His donations have helped to improve education, science, the arts, and social justice.

Mathematical modeling

Mathematical modeling is the process of developing mathematical models to represent real-world systems or phenomena. These models can be used to make predictions, test hypotheses, and design new systems. Mathematical modeling is an essential part of many fields, including science, engineering, and economics.

Jim Simons' education in mathematics gave him the skills necessary to develop and implement mathematical models for trading financial markets. His PhD in mathematics from the University of California, Berkeley, and his MBA from the Massachusetts Institute of Technology gave him the theoretical and practical knowledge necessary to develop successful trading strategies.

One of the most important applications of mathematical modeling in finance is the development of risk management models. These models are used to assess the risk of different investments and to make decisions about how to allocate assets. Simons' mathematical modeling skills have allowed him to develop sophisticated risk management models that have helped Renaissance Technologies to achieve superior returns.

Mathematical modeling is a powerful tool that can be used to solve complex problems in a variety of fields, including finance. Jim Simons' education in mathematics gave him the skills necessary to develop and implement mathematical models that have made him one of the most successful hedge fund managers in the world.

Computer science

Computer science is the study of computation, algorithms, data structures, and computer hardware and software. It is a key component of Jim Simons' education and has been instrumental in his success as a hedge fund manager.

- Algorithms: Algorithms are a set of instructions that tell a computer how to perform a task. Simons' education in computer science gave him the skills necessary to develop and implement algorithms for trading financial markets.

- Data structures: Data structures are a way of organizing data in a computer so that it can be accessed and processed efficiently. Simons' education in computer science gave him the skills necessary to develop and implement data structures for storing and managing financial data.

- Computer hardware and software: Computer hardware and software are the physical and digital components of a computer system. Simons' education in computer science gave him the skills necessary to understand and use computer hardware and software to develop and implement trading systems.

- Applications in finance: Computer science has a wide range of applications in finance, including trading, risk management, and portfolio optimization. Simons' education in computer science gave him the skills necessary to develop and implement computer-based solutions to financial problems.

Overall, Jim Simons' education in computer science has been a key factor in his success as a hedge fund manager. His education gave him the skills necessary to develop and implement computer-based solutions to financial problems.

Data analysis

Data analysis is the process of cleaning, transforming, and modeling data to extract meaningful insights. It is a key component of Jim Simons' education and has been instrumental in his success as a hedge fund manager.

- Data cleaning: Data cleaning is the process of removing errors and inconsistencies from data. It is an important step in data analysis, as it ensures that the data is accurate and reliable.

- Data transformation: Data transformation is the process of converting data from one format to another. It is often necessary to transform data in order to make it compatible with the analysis tools that are being used.

- Data modeling: Data modeling is the process of creating a mathematical representation of a real-world system or phenomenon. Data models can be used to make predictions, test hypotheses, and design new systems.

- Applications in finance: Data analysis has a wide range of applications in finance, including trading, risk management, and portfolio optimization. Simons' education in data analysis gave him the skills necessary to develop and implement computer-based solutions to financial problems.

Overall, Jim Simons' education in data analysis has been a key factor in his success as a hedge fund manager. His education gave him the skills necessary to develop and implement computer-based solutions to financial problems.

FAQs on Jim Simons' Education

Jim Simons is a renowned mathematician, hedge fund manager, and philanthropist. His education has played a pivotal role in his success, and many are curious about his academic background.

Question 1: What is Jim Simons' educational background?

Simons holds a PhD in Mathematics from the University of California, Berkeley, and an MBA from the Massachusetts Institute of Technology.

Question 2: How has Simons' education contributed to his success in the finance industry?

Simons' PhD in Mathematics provided him with a deep understanding of quantitative methods and modeling, which are essential for developing and implementing trading strategies. His MBA from MIT complemented this foundation with business and management skills, enabling him to effectively manage Renaissance Technologies, the hedge fund he founded.

Question 3: What is the significance of Simons' PhD in Mathematics?

Simons' PhD in Mathematics equipped him with the advanced mathematical and analytical skills necessary to develop sophisticated trading models. These models leverage statistical techniques, probability theory, and optimization algorithms to identify undervalued assets and make profitable trades.

Question 4: How did Simons' MBA from MIT enhance his abilities?

Simons' MBA from MIT provided him with a comprehensive understanding of business management, finance, and accounting. This knowledge enabled him to make sound investment decisions, manage risk effectively, and lead Renaissance Technologies' team of professionals.

Question 5: What are some of the key takeaways from Simons' educational journey?

Simons' educational path highlights the importance of a strong foundation in mathematics and business for a successful career in finance. It also underscores the value of interdisciplinary knowledge and the ability to apply theoretical concepts to practical applications.

Question 6: What advice would Simons give to aspiring finance professionals?

Simons has emphasized the importance of pursuing a rigorous education in mathematics, computer science, and finance. He also advises aspiring professionals to develop strong analytical, problem-solving, and communication skills.

Summary: Jim Simons' education has been a cornerstone of his remarkable achievements in the finance industry. His PhD in Mathematics and MBA from MIT have provided him with a unique combination of quantitative and business expertise, enabling him to develop innovative trading strategies and build a highly successful hedge fund.

Transition to the next article section: This concludes our exploration of Jim Simons' education. In the next section, we will delve into his professional career and the founding of Renaissance Technologies.

Tips for Pursuing a Path Similar to Jim Simons'

Jim Simons' success as a hedge fund manager and philanthropist is a testament to the power of education and hard work. By following these tips, you can increase your chances of achieving similar success:

1. Pursue a Strong Foundation in Mathematics:Quantitative skills are essential for success in finance. Consider majoring in mathematics, statistics, or a related field to develop a solid foundation in mathematical concepts and problem-solving.2. Develop Expertise in Computer Science:

Technology plays a vital role in modern finance. Enhance your employability by gaining proficiency in programming languages, data analysis techniques, and machine learning algorithms.3. Seek an MBA from a Top Business School:

An MBA from a reputable institution will provide you with a comprehensive understanding of business principles, management practices, and financial analysis. This knowledge is invaluable for managing a hedge fund or other financial organization.4. Build a Network of Mentors and Advisors:

Identify experienced professionals in the finance industry who can provide guidance, support, and industry insights. Attend industry events and conferences to connect with potential mentors.5. Stay Updated with Financial Trends:

The financial landscape is constantly evolving. Make a habit of reading industry publications, attending webinars, and engaging in professional development activities to stay abreast of the latest trends and best practices.6. Cultivate Analytical and Problem-Solving Skills:

Success in finance requires the ability to analyze complex data, identify patterns, and solve problems effectively. Develop these skills through coursework, internships, and real-world experiences.7. Emphasize Communication and Presentation Skills:

Strong communication skills are essential for conveying your ideas clearly and persuasively. Practice presenting your insights and research findings to diverse audiences, including investors and colleagues.8. Embrace a Growth Mindset:

The finance industry is constantly evolving. Foster a growth mindset by seeking continuous learning opportunities, adapting to new technologies, and being open to constructive feedback.

By incorporating these tips into your educational and professional journey, you can increase your chances of achieving success in the field of finance.

Conclusion: Education plays a pivotal role in shaping one's career trajectory. By emulating the educational path of successful individuals like Jim Simons, you can equip yourself with the knowledge, skills, and mindset necessary to thrive in the competitive and rewarding world of finance.

Conclusion

Jim Simons' educational background serves as a testament to the transformative power of knowledge and perseverance. His PhD in Mathematics and MBA from prestigious institutions laid the groundwork for his success as a hedge fund manager and philanthropist.

Simons' journey underscores the importance of a rigorous education in mathematics, computer science, and business for a thriving career in finance. His commitment to continuous learning and innovation has shaped Renaissance Technologies into one of the most successful hedge funds globally.

The exploration of Jim Simons' education not only sheds light on his personal trajectory but also offers valuable insights for aspiring finance professionals. By embracing a strong educational foundation, developing analytical and problem-solving skills, and cultivating a growth mindset, individuals can position themselves for success in the ever-evolving financial landscape.

Unveiling Justin Kan's Net Worth: Discoveries And Insights

Unveiling The Complex Marriages Of Rick James: Discoveries And Insights

Unveiling Michael Ealy's Brother: A Journey Of Film And Family

ncG1vNJzZmiZmaOxorSNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLbIpmSsoZ2ku7R5xJ2snJmknryvesetpKU%3D